- Job ads fall 3.5%

- Credit scores explained

- Prices still rising

- ATO issues tax warning

Read more below.

Jobs & Skills Australia (JSA) has reported a clear easing in the labour market, although it remains tighter than before the pandemic.

The recruitment rate (which reflects the share of employers recruiting) was 50% in the December 2023 quarter – which was higher than the 48% recorded in the previous quarter but lower than the 56% from the previous year.

The number of job ads in the December quarter fell 3.5% quarter-on-quarter and 5.8% year-on-year.

As a result, more workers had to chase fewer jobs. There were 18.1 applicants per vacancy in December, compared to 17.0 the quarter before and 13.6 the year before. And there were 2.7 suitable applicants per vacancy, compared to 2.6 the quarter before and 2.2 the year before.

In total, Australia's labour force worked 0.4% fewer hours in the December quarter than the September quarter. The number of hours worked actually increased 1.2% in annual terms, but this was less than the 2.8% increase in jobs, which meant the average employee worked fewer hours.

JSA said labour market activity was likely to slow further in the coming months, while the unemployment rate was likely to drift higher.

|

Just like in the personal finance world, companies have credit scores that lenders review when assessing a business finance application.

The higher your company's credit score, the more likely you are to have your application approved – and to be given a lower interest rate and more favourable borrowing terms.

There are three main criteria that determine your credit score, according to commercial credit reporting bureau CreditorWatch.

- Financial stability – Begin by assessing the consistency and resilience of your revenue streams, by reviewing business financial statements, balance sheets and cash flow patterns. “This step is part of a bank or lender’s credit application process, so you should assess the stability of a business with your own eyes,” CreditorWatch said.

- Payment history – Next, examine your company's track record for payments. “Timely and consistent payments showcase reliability and responsibility. For example, if you frequently pay your bills and other invoices late, ask yourself: would you lend your business money?”

- Reputation – Finally, consider how your business is perceived in the industry and among clients. “ A positive reputation signifies trustworthiness and reliability,” according to CreditorWatch.

|

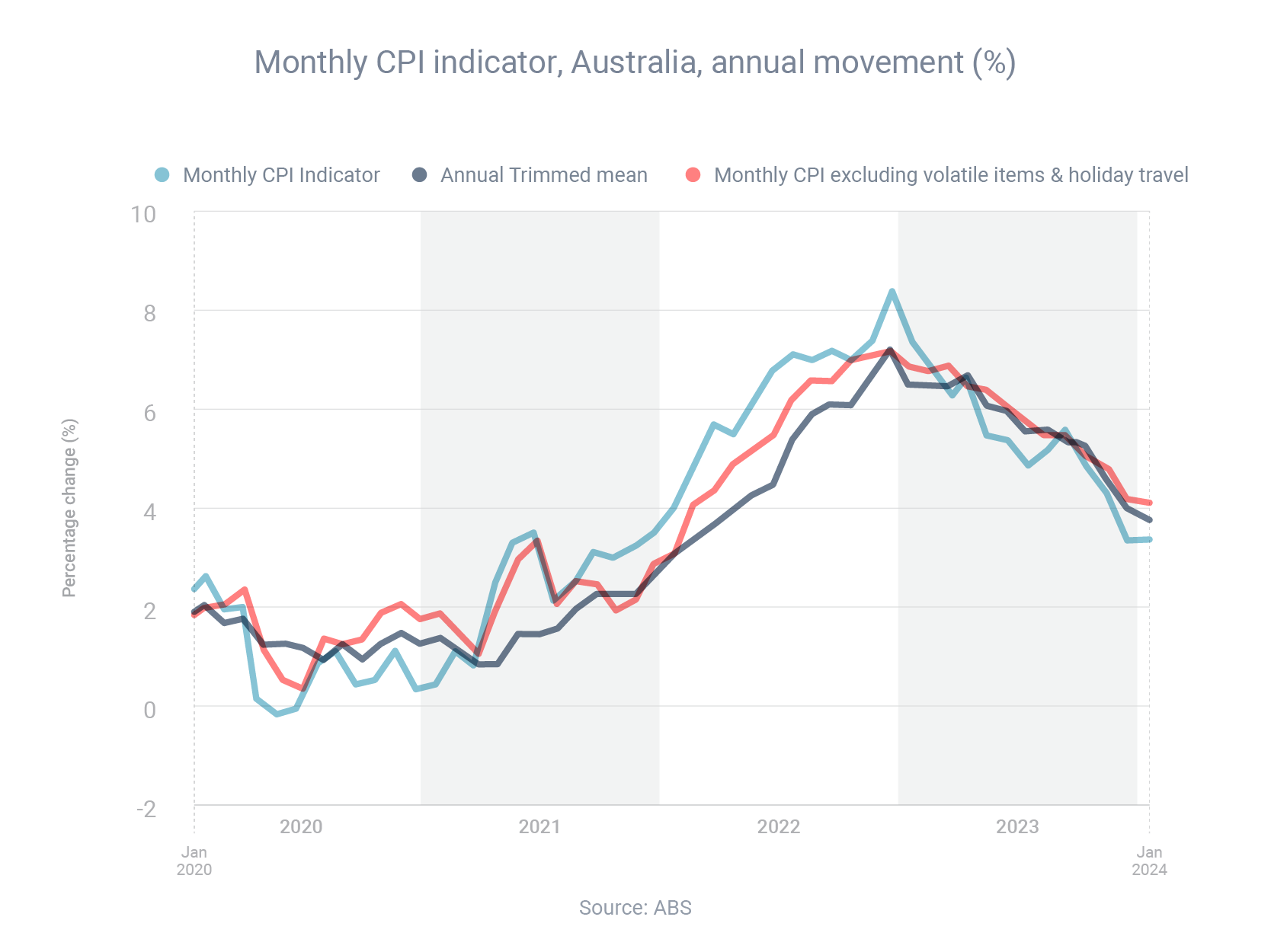

Inflation held steady in January, with the consumer price index coming in at an annual rate of 3.4% for the second consecutive month, according to the Australian Bureau of Statistics.

Over the year to January, the main contributors to inflation were insurance & financial services (whose prices increased 8.2%), alcohol & tobacco (6.7%) and education (4.7%).

Conversely, price rises were small or even negative for clothing & footwear (0.4%), furnishings, household equipment & services (0.3%) and recreation & culture (-1.7%).

While inflation has fallen from a peak of 8.4% in December 2022, the Reserve Bank of Australia (RBA) faces a challenge to return inflation to its target range of 2-3%.

|

In an appearance before the Senate Economics Legislation Committee last month, RBA Governor Michele Bullock said demand still exceeded the ability of the economy to supply goods.

"What monetary policy is doing is trying to slow demand so that, as supply continues to recover, gradually they will come back more into balance. Our judgement at the moment is that that's happening. Yes, growth rates are slowing, but aggregate demand is still above aggregate supply, and that's what's generating inflationary pressures,” she said.

|

“It’s important to stay on top of your reporting, lodgment and payment due dates,” the Australian Taxation Office (ATO) has warned businesses. “If you don't, it could cost you more money in penalties and interest.”

The ATO said employers had several obligations when hiring staff:

- Determine whether the worker is an employee or contractor

- Confirm the person is legally allowed to work in Australia

- Ask the worker to complete the standard online commencement forms, tax file number declaration and standard choice super form

When workers leave, employers must:

- Pay superannuation on any final salary and wage payments

- Report any fringe benefits you provided

The ATO also reminded businesses that help may be available if unexpected events make it hard to meet their employer obligations.

“If you are having difficulty paying in full, or on time, contact us before the due date to discuss your options including a payment plan,” the ATO said.

Disclaimer: The information provided above is on the understanding that it is for illustrative and discussion purposes only. Any party seeking to rely on its content or otherwise should make their own enquiries and research to ensure its relevance to your specific personal and business requirements and circumstances.